|

| |

|

| |

|

| |

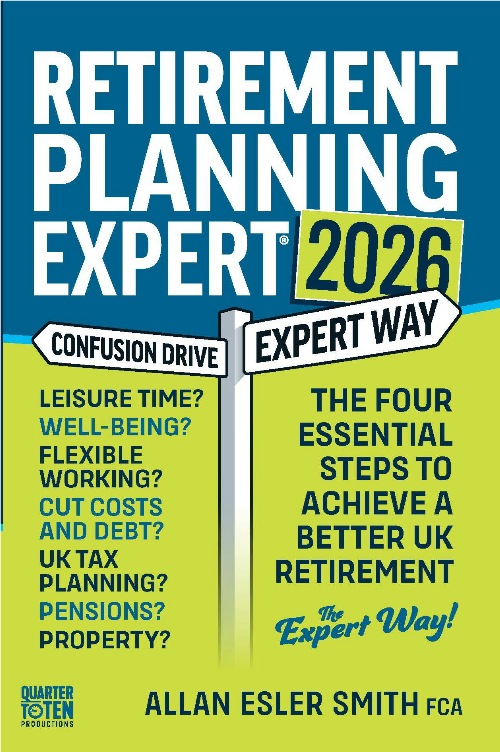

| Retirement Planning Expert ® 2026 |

| Plan more, save more, earn more, live better and achieve a better retirement with the Number 1 BEST SELLER on Amazon UK in 2022, 2023, 2024 and 2025. Retirement Planning Expert 2026 provides the best in depth coverage in the UK of: |

| |

|

|

Achieving a glidepath not cliff-edge retirement |

|

UK tax planning for 2025/26 & 2026/27 |

|

Right-sizing property |

|

Cutting through the waffle on pensions and savings |

|

Improved leisure time & well-being |

|

Flexible working options |

|

Cutting costs and debt |

| This could be your reset moment in 2026 and you might even retire 5 years earlier. This bestselling UK retirement planning book will help you achieve a better retirement. You can buy Retirement Planning Expert 2026 via the Amazon UK secure link here:

https://amzn.eu/d/04nrs6pG |

| |

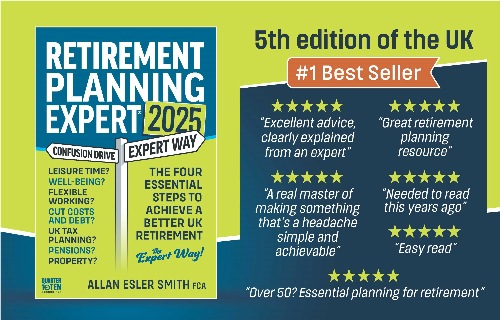

| Retirement Planning Expert 2025 was number one Amazon UK best seller in the categories Tax Law and Personal Taxation. |

| |

|

| |

Retirement Planning Expert 2024 was number one Amazon UK best-seller in the categories: Professional Taxation, Self Employed and Small Business.

|

|

|

Retirement Planning Expert 2023 was number one Amazon UK best-seller in The Professional Taxation category.

|

|

| |

Retirement Planning Expert 2022 was number one Amazon UK best-seller in the Financial Retirement Planning category and the Personal Taxation category.

|

|

|

| |

|

| |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

| |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

| |

|

|

| |

|

|

|

|

|